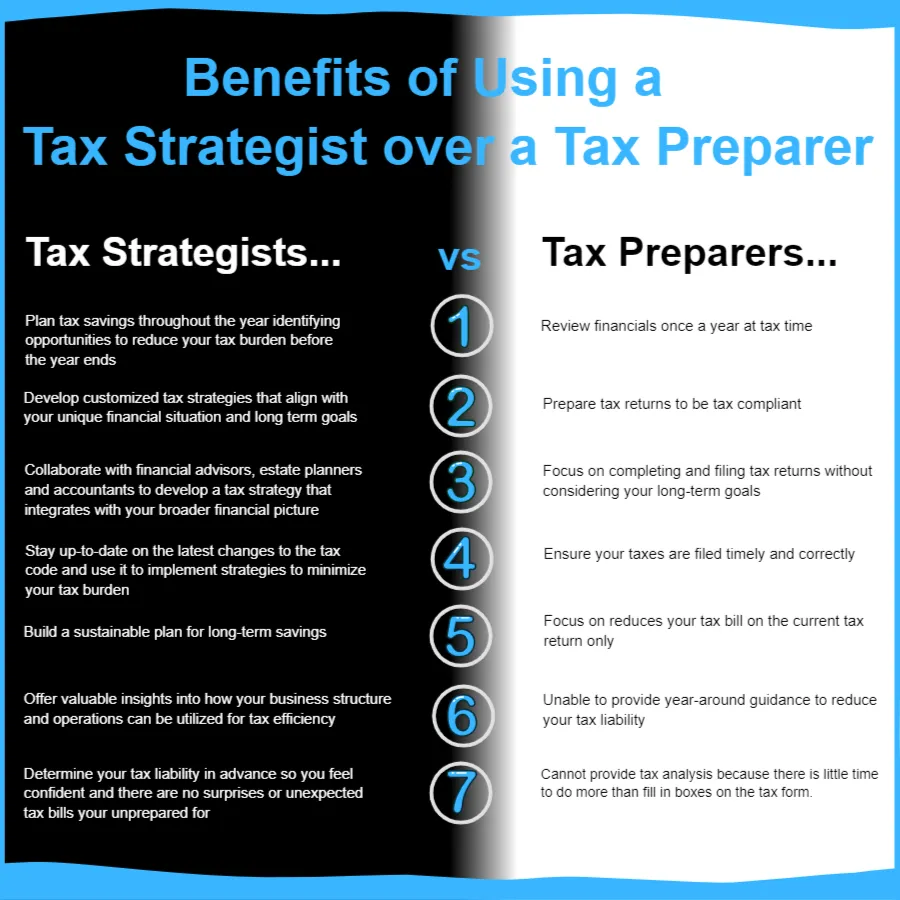

At The Miller Parker Firm, our Tax Planning Services go beyond simply preparing and filing your taxes. We focus on developing personalized, strategic plans that minimize your tax liability while ensuring full compliance with the latest tax regulations. Our proactive approach allows businesses and individuals to optimize their tax position throughout the year, not just during tax season.

With tax laws constantly changing, staying on top of potential savings opportunities can be challenging. Our team of experienced CPAs and tax strategists work closely with you to create custom tax strategies that align with your financial goals, helping you save money and make smarter financial decisions.

Whether you're a business owner looking to reduce your tax burden or an individual aiming to maximize your tax deductions, our tax planning services are designed to give you peace of mind and a clear roadmap to financial success.

Strategic Tax Planning

Strategic tax planning is beneficial for a wide range of individuals and businesses looking to minimize tax liabilities, avoid penalties, and optimize their financial standing. The following groups can greatly benefit from investing in tax planning services:

Business Owners:

Entrepreneurs, startups, and established business owners all face complex tax obligations. Strategic tax planning ensures that your business is structured in the most tax-efficient manner, taking advantage of all available deductions, credits, and incentives. This can lead to significant tax savings and improved cash flow for your business.

High-Income Earners:

Individuals with high-income levels often encounter higher tax brackets, which can substantially impact their earnings. Tax planning helps high-income individuals reduce their taxable income by leveraging deductions, credits, and investment strategies that provide tax benefits.

Investors and Property Owners:

Those who invest in stocks, bonds, real estate, or other assets can benefit from tax planning strategies that minimize capital gains taxes, maximize investment returns, and take advantage of tax deferral opportunities. Real estate investors, in particular, can use tax planning to navigate complex depreciation rules, 1031 exchanges, and property deductions.

Individuals Facing Major Life Events:

Major life changes such as marriage, retirement, the birth of a child, or inheriting assets can have a substantial impact on your tax situation. A well-structured tax plan helps ensure you’re prepared for these changes and can make informed financial decisions that align with your tax goals.

Expats and International Business Owners:

Individuals or businesses with international ties face unique tax challenges, including dual taxation and foreign income reporting. Tax planning services can help navigate these complexities, ensuring compliance with both domestic and international tax laws while minimizing tax liabilities.

Self-Employed Individuals:

Freelancers, consultants, and independent contractors often have more complicated tax situations due to self-employment taxes, deductions for business expenses, and retirement planning. Strategic tax planning can ensure you’re taking full advantage of these deductions while remaining compliant with tax regulations.

Share Your Interest

Tax Planning Inquiry

I Consent to Receive SMS Notifications, Alerts & Occasional Marketing Communication from The Miller Parker Firm. Message frequency varies. Message & data rates may apply. Please reach out to +1(855)449-2727 with any questions. You can reply STOP to unsubscribe at any time.

Why Work With Us

At The Miller Parker Firm, we specialize in helping both individuals and businesses develop tax strategies that minimize liabilities and maximize financial outcomes. Our team of CPAs and tax strategists are dedicated to offering personalized, proactive tax planning that adapts to your unique situation.

With a deep understanding of the tax code and a commitment to helping you achieve your financial goals, our tax planning services go beyond compliance — we work with you to develop comprehensive, long-term strategies that save you money and provide peace of mind.

Whether you're a business owner looking to reduce corporate taxes, or an individual seeking to minimize personal tax burdens, The Miller Parker Firm offers the expertise and guidance you need to succeed. Contact us today to schedule a consultation and start building a tax-efficient financial future.

Maximize your tax savings and take control of your financial future with The Miller Parker Firm's expert tax planning services.

260 Peachtree St NW, Suite 2200

Atlanta, GA 30303

Copyright 2024 | The Miller Parker Firm LLC | All Rights Reserved.

Copyright 2024

The Miller Parker Firm LLC

All Rights Reserved.