At The Miller Parker Firm, we understand that every business has unique needs when it comes to financial management. That’s why we offer specialized bookkeeping services tailored to meet your specific requirements.

Whether you're a small business, a rapidly growing startup, or an established company, our three distinct bookkeeping packages ensure that your financial records are accurate, compliant, and prepared for any eventuality.

Tax Ready Bookkeeping

Tax-Ready Bookkeeping is an annual service we provide to get business bank and credit card transactions in good condition for tax return preparation. All statement transactions are compiled and categorized for input to the tax return. With the exception of beginning balances, client records are not used to compile tax ready bookkeeping.

What's Included:

Annual Transactions

Bank and credit card statements covering business transactions for the tax year.

Categorize Transactions

Statement transactions are categorized for input on the tax return.

Annual Reports

Balance Sheet, Income Statement

and Cash Flow Statement

Benefits:

Cost Savings

Save on monthly bookkeeping costs.

Time Savings

Reduce time with organized records.

Error Reduction

Avoid forgotten or missing transactions.

Best for:

Low Volume Businesses

Less than 200 transactions annually.

Side Hustle Businesses

Full Time job plus a side business.

Traditional Bookkeeping

Traditional bookkeeping is our foundational monthly service designed for businesses that need regular tracking of day-to-day financial transactions. This service uses daily bank feeds to ensure financial records are always up-to-date, organized, and available for periodic reviews.

What's Included:

Monthly Transactions

Bank feeds, bank statements, and credit card statements are reviewed for completeness.

Categorize Transactions

Assets, liabilities, income and expenses are categorized for proper tax treatment.

Monthly Reconciliations

Reconcile bank and credit card statements monthly to identify and resolve inconsistencies.

Monthly Reports

Balance Sheet, Income Statement and Cash Flow Statement.

Add-on Options:

Quarterly Financial Statement Reviews

Review business performance using metrics and financial goals.

Semi-Annual Tax Planning Sessions

Review financial reports for potential tax savings.

Benefits:

Accuracy

Maintain organized and accurate records.

Efficiency

Manage routine financial data

Clarity

Know your business health at any time.

Great For:

Freelancers

Solo Practitioners that require reliable financial reports to calculate estimated tax payments and potential tax savings.

Small Businesses

Business owners that require reliable support to maintain accurate monthly records for tax preparation and tax savings opportunities.

Audit-Ready Bookkeeping

Audit-Ready Bookkeeping goes beyond traditional bookkeeping by ensuring that your financial records are always ready for an audit. While the bookkeeping is done monthly, audit-ready includes more rigorous attention to detail, transaction support documentation, IRS deduction compliance and adherence to accounting standards. Any unsupported transactions may be included in the financial reports, however they will be marked as not deductible until adequate supporting documentation can be provided.

What's Included:

Monthly Transactions

Bank feeds, bank and credit card statements are reviewed for completeness and supporting documentation.

Categorize Transactions

Transactions with supporting documentation are categorized for proper tax treatment.

Monthly Reconciliations

Reconcile bank and credit card statements monthly to identify and resolve inconsistencies.

Monthly Reports

Monthly Balance Sheet, Income Statement and Cash Flow Statements have supporting documentation for all transactions.

PBC File System

Prepared By Client (PBC) file system is compiled and placed on a cloud base portal for easy client access to fulfill audit requests.

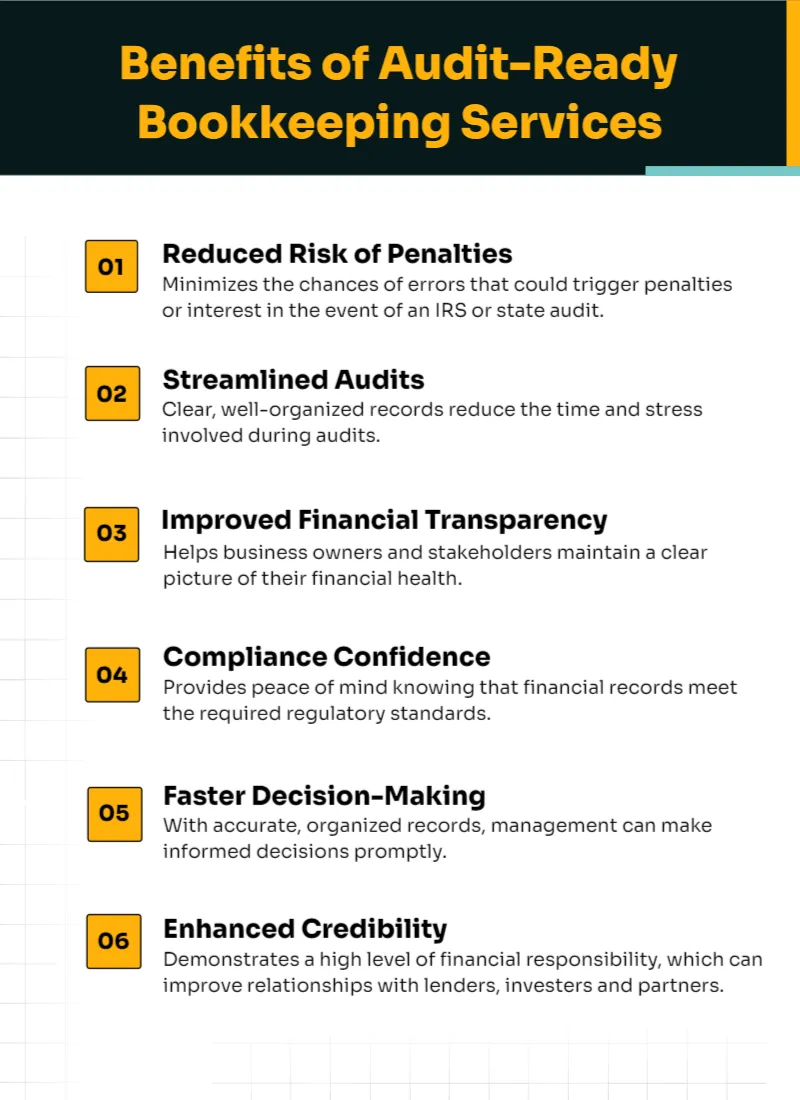

Benefits:

Reliability

Fast access to documentation and reports increases auditor confidence that information can be relied upon.

Financial Savings

Having records readily available reduces the risk of scope creep which can be unnecessarily costly.

Great For:

Businesses Frequently Audited

Quick access to financial records for any documentation request.

Businesses With High Regulatory

Businesses with loans that require financial statements regularly.

Audit Ready Improves IRS Audit Outcomes

Prevents Red Flags

Ensures that all records are accurate, reconciled and categorized to avoid discrepancies that might attract scrutiny.

Provides Proper Documentation

Every transaction is backed by source documents, reducing the likelihood of disallowed deductions or adjustments.

Facilitates Open Communication

Quickly provide auditors with requested information, fostering trust and cooperation throughout the audit.

Minimizes Audit Scope

When auditors see organized and accurate records, they are less likely to dig deeper, potentially reducing the audit’s scope.

Reduces Stress and Cost

A proactive approach saves time and money by voiding last-minute scrambling to gather necessary documents.

Share Your Interest

Bookkeeping Inquiry

I Consent to Receive SMS Notifications, Alerts & Occasional Marketing Communication from The Miller Parker Firm. Message frequency varies. Message & data rates may apply. Please reach out to +1(855)449-2727 with any questions. You can reply STOP to unsubscribe at any time.

Why Partner With Us

With decades of experience, our team knows the ins and outs of business accounting and compliance. We tailor our services to meet your specific business needs so you can focus on growing your business while we handle the complexities of your financial management.

Contact us today to learn more about which bookkeeping service best suits your business.

260 Peachtree St NW, Suite 2200

Atlanta, GA 30303

Copyright 2024 | The Miller Parker Firm LLC | All Rights Reserved.

Copyright 2024

The Miller Parker Firm LLC

All Rights Reserved.